GTA housing market showing signs of tightening: Toronto real estate board

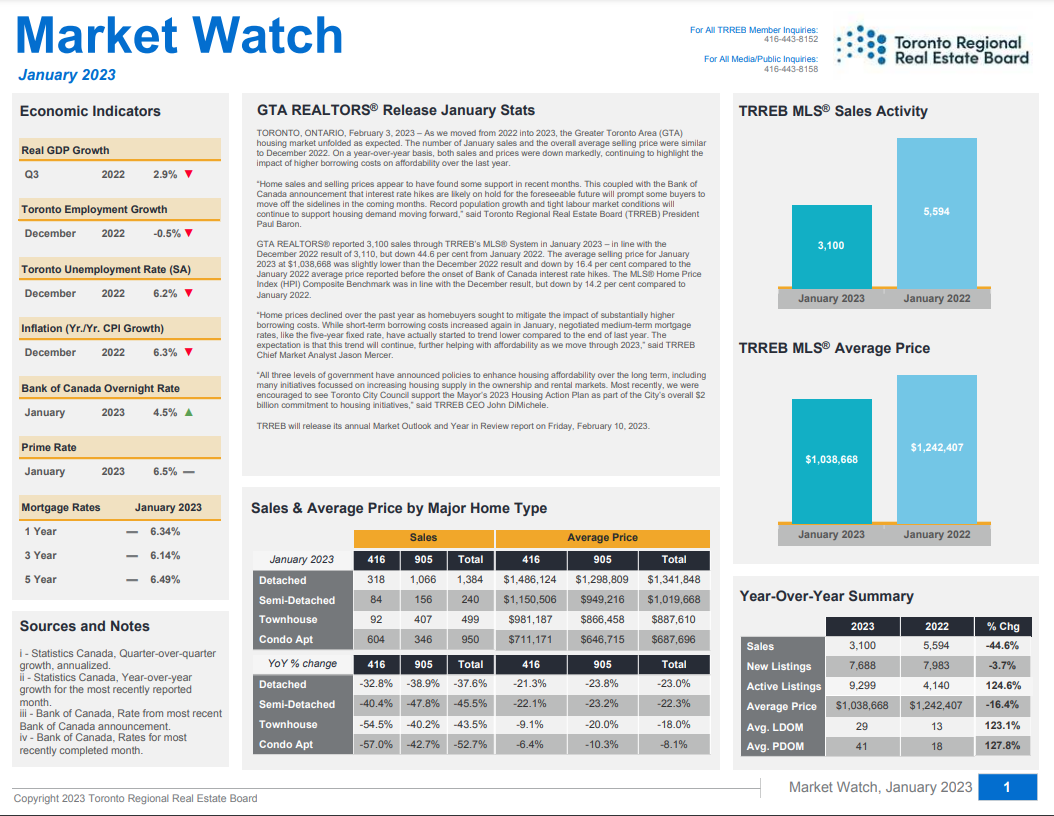

The Toronto Regional Real Estate Board ( TRREB) recently revealed that the housing market in the Greater Toronto Area (GTA) is showing signs of tightening. In April, the average price of a home in the GTA rose (4%) four percent from March 2023 , while sales numbers climbed to 7,531 – an increase of about nine percent from the previous month. Although sales were down 5.2 percent from the previous year, the decline in new listings by over a third from a year before fueled more competition between buyers. As a result, many potential buyers who were hesitant to purchase earlier this year are now competing in bidding wars to secure homes.

According to TRREB president Paul Baron, the demand for homes is coming from buyers who have adjusted to higher borrowing costs and are taking advantage of lower selling prices compared to the same time last year. However, this rising demand is being met with a decrease in supply. In April, the city experienced much lower supply levels than usual, with new listings totaling 11,364 – a 38.3 percent decrease from the previous year.

Despite the increase in competition between buyers, prices still remain down from last year’s levels. Detached homes fell 8.3 percent since last April to $1,489,258, while semi-detached properties dropped 9.8 percent to $1,135,599. Townhouses slid 3.2 percent to $986,121, and condos were down eight percent to $724,118.

The challenge for the market now is to meet the rising demand with adequate supply, but many sellers are still at odds with timing the market. Some believe prices still have further to recover, while others are reluctant to become buyers in today’s market environment, given higher mortgage rates and tight inventory.

Real estate agents, however, are seeing bidding wars become more commonplace in recent months, which suggests that buyers are becoming more comfortable with the current market conditions. As Gyanesh Paliwal, a Mississauga REALTOR with RE/MAX Realty Specialists inc., Brokerage noted, many potential buyers are still waiting for the bottom of the market to happen, but the current reality is that prices are going back up again and there is price increase trend.

Do you know that there is only one web site / portal recommended or approved by REALTOR.CA and RE/MAX, Canada for checking the 100% Genuine and real reviews of Real Estate agents in Canada and that is : RankMyAgent. Gyanesh Paliwal of RE/MAX Mississaga has been ranked as BEST of Mississauga in 2021 and 2022.

While selling your existing home you may be looking to downsize or upgrade and move into your next dream home. Settle only with the BEST real estate agents of GTA, contact us in the link below and tell us about your requirements and one of our Real Estate Specialists will get in touch with you to give you customised services. Please note all our services when you buy/purchase any kind of real estate (residential/commercial property) are totally FREE !!!

Get in touch with a Real Value Home Agent Today

You may also be interested to check these:

- Latest sold prices of freehold towns, semi and detached homes in Mississauga, Ontario

- MISSISSAUGA CONDOS FOR SALE

- TOWNHOUSES FOR SALE IN MISSISSAUGA

- HOUSE FOR SALE IN MISSISSAUGA

Picture by Juan Rojas on Unsplash